Table of Contents

ToggleThe 80/20 Rule for Money (Pareto Principle)

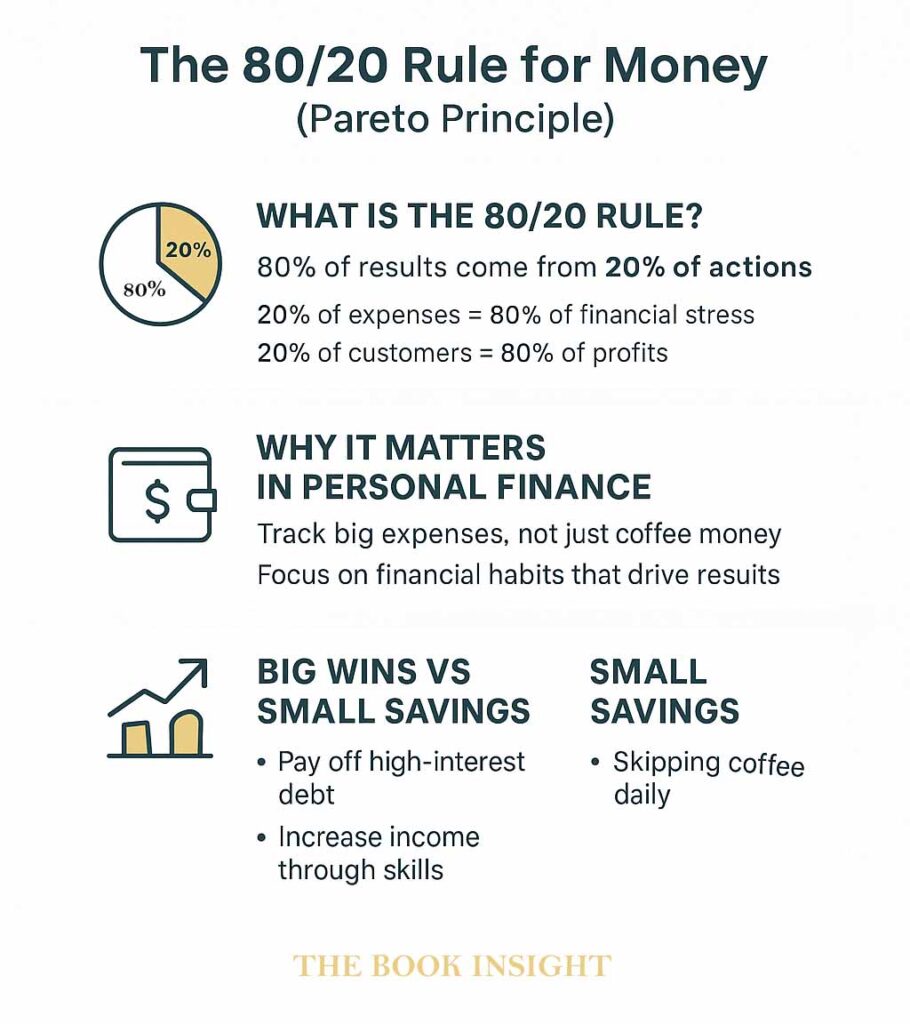

The 80/20 Rule, also known as the Pareto Principle, states that 80% of outcomes are driven by just 20% of inputs. In simple terms, a small portion of causes often creates the majority of results. This principle shows up everywhere in daily life:

- 20% of plants may produce 80% of the fruits.

- 20% of customers often generate 80% of a company’s profits.

- Even in tasks like Excel, mathematics, or project work, a minor 20% detail can shape nearly 80% of the overall outcome.

This idea isn’t just a mathematical curiosity—it’s a powerful framework to improve productivity, decision-making, and especially personal finance. By identifying the few high-impact actions that truly matter, you can save time, money, and energy.

Why It Matters in Personal Finance?

The 80/20 Rule is easily applicable to money management. You don’t need complex tools—simply prepare a three-month expense sheet and you’ll notice that 20% of your spending habits drive 80% of your financial stress. For example:

- Overspending on lifestyle upgrades might block your ability to save.

- Lack of investments may come from just a few poor financial choices.

By spotting these patterns, you can shift from reactive spending to smart money habits that prioritize saving, investing, and long-term growth. This small shift can completely transform your financial future.

Most People Waste Energy Cutting Small Expenses Instead of Focusing on Big

Wins.

Unfortunately, many people get distracted by minor savings—like cutting out coffee or shopping less—while ignoring big financial wins. While reducing unnecessary spending has value, it rarely builds lasting wealth. The real financial breakthroughs come from:

- Negotiating a higher salary.

- Eliminating high-interest debt.

- Starting an investment plan.

The Pareto Principle teaches us that lasting success comes not from obsessing over pennies but from focusing on the handful of financial actions that create the biggest results.

What is Pareto Principle?

Origin of the Concept – Vilfredo Pareto

The 80/20 Rule originates from the work of Vilfredo Pareto, an Italian economist and sociologist, in the early 1900s. While studying wealth distribution in Italy, Pareto observed that 20% of the population owned 80% of the land. This discovery highlighted a natural imbalance where a small percentage of causes creates a large percentage of results.

Pareto later expanded this observation, and the idea became widely known as the Pareto Principle. Mathematically, it relates to a power law distribution (often called the Pareto distribution), where certain outcomes are disproportionately concentrated in a small fraction of inputs.

A common example in business is that 20% of customers often generate 80% of sales. For instance:

- 20% of loyal, repeat customers may drive 80% of a company’s revenue.

- On the other hand, 80% of one-time customers may contribute only 20% of revenue.

This principle has since become a foundation in economics, management, and productivity studies.

The Basic Idea – 20% of Efforts Drive 80% of Results

At its core, the Pareto Principle demonstrates that not all efforts are equal. A small fraction of inputs (the vital 20%) delivers the majority of outputs (the useful 80%). Recognizing this imbalance helps individuals and businesses focus on what truly matters instead of spreading energy thin across everything.

How It Applies Beyond Business – Health, Productivity, and Money

Although the rule started with wealth distribution, it applies far beyond economics:

- Business: A small portion of products (20%) may generate most of the profit. Companies that identify and prioritize these products gain a competitive edge while minimizing focus on less impactful offerings.

- Health: Around 20% of unhealthy habits—such as smoking, excessive alcohol, or junk food—may cause 80% of negative health issues, including obesity, fatigue, and chronic disease. Eliminating these destructive habits can drastically improve overall well-being.

- Productivity: In work and personal life, 20% of your tasks may produce 80% of your results. Prioritizing these high-value activities instead of getting lost in busy work leads to greater efficiency.

- Money: In personal finance, a few critical actions—like increasing income, reducing debt, and investing wisely—often account for 80% of your long-term wealth. By focusing on these “big wins” instead of obsessing over minor expenses, you develop smart money habits that accelerate financial success.

Big Wins That Transform Your Finances (20% Efforts with 80% Results)

The 80/20 Rule teaches us that a small number of financial decisions drive the majority of our results. Instead of obsessing over minor cost-cutting (like skipping coffee or shopping less), focus on big wins vs small savings. These high-impact choices form the 20% of actions that deliver 80% of your wealth-building success.

1. Increasing Income Through Skills, Career Growth, and Side Hustles

Your income is the foundation of all financial success. By dedicating even 20% of your effort to learning new skills, building expertise, or pursuing side hustles, you can create long-term rewards that far outweigh short-term savings.

- Action: Invest in certifications, online courses, or skill development that boosts your career value.

- Impact: A better-paying job, a career switch, or a profitable side business could generate the 80% of financial results you’re looking for.

This is one of the most powerful financial success strategies because raising your income unlocks greater opportunities for saving and investing.

2. Investing Early and Wisely

Another high-impact habit is starting investments early. Even a small percentage of your time dedicated to learning about investments pays off for decades.

- Action: Spend 20% of your time understanding basics—stocks, mutual funds, index funds, or real estate.

- Impact: That initial learning translates into 80% of your long-term wealth through compounding returns.

The key is consistency: small, regular contributions to diversified investments grow into significant wealth over time.

3. Paying Off High-Interest Debt

High-interest debt is one of the biggest obstacles to financial freedom. Eliminating it often produces greater results than chasing small savings.

- What to Do: List your top financial goals (e.g., debt repayment, emergency fund, retirement savings).

- Example: Paying off a credit card with a 20% APR has a far bigger impact on your stability than cutting back on dining out.

- Action: Use strategies like the debt avalanche method to tackle high-interest debt first.

- Impact: Greater security, reduced stress, and faster progress toward your long-term goals.

This is a clear case where the 80/20 Rule applies—focus on the 20% of financial decisions (like killing debt) that bring 80% of peace of mind.

4. Automating Savings and Budgeting

The smartest financial systems are often the simplest. Automating your money ensures consistency and prevents decision fatigue.

- Action: Set up automatic transfers to savings accounts, investment accounts, or retirement funds.

- Example: Contributing to a 401(k) or investing in low-cost index funds requires only one decision but compounds for decades.

- Impact: You lock in the 20% of financial decisions that create 80% of your wealth over time.

Avoid chasing short-term trends like frequent stock trading or speculative crypto bets. Instead, stick to smart money habits like automation and diversification, which guarantee steady growth.

Common Mistakes People Make with Money

The 80/20 Rule shows us that a small number of decisions drive the majority of financial outcomes. Yet, many people focus on the wrong areas—chasing tiny savings while ignoring the big moves that actually build wealth. Here are the most common mistakes that stop people from achieving financial freedom.

1. Obsessing Over Cutting Coffee & Small Luxuries

Too many people fall into the trap of over-analyzing every small expense—like coffee, snacks, or occasional shopping—while ignoring the big wins vs small savings principle. Cutting minor luxuries may help a little, but it doesn’t fix the core of poor financial management.

Example:

Siya earns around $40,000 per month, but she chooses to live in an upscale society, rents a luxury apartment, and drives a Mercedes-Benz. While she tries to “save money” by skipping weekend outings or small expenses, her largest costs—rent, car, and maintenance—consume most of her income. A smarter move would be to downsize her apartment or reduce luxury spending, which would free up far more money than cutting coffee ever could.

This is where applying the 80/20 Rule matters: focus on the 20% of expenses that eat 80% of your budget, not the other way around.

2. Ignoring Long-Term Investments

Another mistake is keeping money in liquid form for instant access instead of committing to long-term investments. Many young adults prefer having cash ready for spending rather than putting money into assets like government bonds, gold bonds, or index funds that grow steadily over time.

This short-term mindset limits financial growth. Smart investors know that the 20% of decisions—like starting early with long-term investments—will deliver 80% of future wealth. Ignoring this opportunity is one of the biggest lost chances for building lasting prosperity.

3. Over-Focusing on Penny-Pinching Instead of Wealth-Building

When faced with financial uncertainty, such as job layoffs, many people react by obsessively trying to “save more” instead of creating a plan to earn more. They cut back on small pleasures but ignore the real opportunities to grow wealth—like learning new skills, switching jobs, or starting a side hustle.

This mindset is the opposite of smart money habits. Instead of fixating on pennies, focus on financial success strategies that increase income, expand opportunities, and build long-term assets. That’s how you escape survival mode and move toward financial independence.

Practical Steps to Use the 80/20 Rule in Your Finances

Understanding the 80/20 Rule is only the first step—the real transformation comes when you apply it to your financial life. By focusing on a few key actions, you can build lasting wealth with far less effort. Here’s how to put the principle into practice.

1. Identify Your “Money Drivers”

Think of your finances like driving a car: without proper direction, you risk going off-road. Tracking your expenses is the GPS that keeps you on course.

- Use expense-tracking apps, Excel sheets, or even a small diary to log your daily spending.

- Look for the 20% of expenses that consume 80% of your budget.

- Once identified, you can decide whether to cut, reduce, or redirect those costs.

This step helps you see where your money is truly going and lays the foundation for smart money habits.

2. List Out Top 3–5 Big Financial Decisions

Not all financial goals carry the same weight. Instead of spreading yourself thin across dozens of small goals, focus on the few big decisions that will bring the greatest results.

Examples of high-impact financial moves:

- Paying off high-interest debt.

- Building an emergency fund.

- Starting a retirement account or long-term investment plan.

- Negotiating a raise or improving income sources.

By prioritizing these, you follow financial success strategies that align with the 80/20 Rule—a few actions that create the biggest results.

3. Eliminate Distractions (Low-Value Savings Hacks)

We live in a world full of distractions—flash sales, new product launches, endless shopping notifications. These temptations often lead us to chase small savings instead of focusing on big wins vs small savings.

- Ignore the hype around “limited-time” offers that encourage unnecessary spending.

- Ask yourself: Will this purchase help me achieve my bigger financial goals?

- Replace low-value savings hacks with high-value strategies like debt repayment or automated investing.

This mindset shift ensures your focus stays on the financial actions that truly move the needle.

4. Create a Personal Money System

Wealth is built through systems, not random efforts. Creating a simple, automated money system ensures consistency and removes decision fatigue.

- Set up automatic transfers for savings and investments right after payday.

- Automate bill payments to avoid penalties or late fees.

- Keep a simple, diversified investment plan (e.g., index funds) that doesn’t require daily monitoring.

This approach locks in the 20% of financial decisions that create 80% of your long-term results. By systemizing your money, you guarantee steady progress toward wealth without constant stress.

The Psychology Behind the 80/20 Rule

Money decisions aren’t just about numbers—they’re deeply tied to our emotions and psychology. Understanding why we sometimes chase small wins instead of focusing on big wins vs small savings can help us adopt better financial success strategies.

Why People Feel Better About Small Wins?

- Instant gratification: Small savings, like skipping a coffee or using a discount coupon, give us a quick sense of control and achievement. They’re visible, easy to measure, and provide immediate satisfaction.

- Illusion of progress: We feel like we’re improving our finances because we can point to small, frequent actions. But in reality, they rarely create lasting financial change.

- Comfort zone effect: Big financial decisions—like investing, negotiating salary, or buying property—feel intimidating, so people stick to the “safer” small moves.

While these habits are not wrong, they often distract us from the 80/20 Rule—where only a few key actions actually drive long-term results.

How to Shift Mindset Toward High-Impact Decisions?

- Reframe your wins: Instead of celebrating saving ₹200 on shopping, celebrate negotiating a salary increase or starting an SIP—these are the true “big wins.”

- Visualize long-term impact: Compare the lifetime value of cutting daily coffee (maybe ₹20,000 a year) versus investing in a retirement fund (potentially several lakhs over time). This perspective highlights the power of high-impact moves.

- Practice deliberate focus: Train yourself to ask: Will this choice move me closer to financial freedom? If the answer is no, it’s likely a low-value distraction.

- Build smart money habits: Automating investments, prioritizing debt repayment, and focusing on income growth are proven financial success strategies that align with the 80/20 Rule.

Conclusion

At the end of the day, money success doesn’t come from cutting out every little luxury—it comes from focusing on the 20% of financial actions that create 80% of results. The 80/20 Rule is a reminder that your energy should go toward the big wins, not endless penny-pinching.

Build smart money habits around the decisions that matter most—like investing consistently, negotiating better income, reducing major unnecessary expenses, and planning for long-term growth. These are the financial success strategies that truly move the needle.

So instead of stressing about every coffee or snack, shift your mindset. Ask yourself: What are the few money moves that will create the biggest impact on my future?

✅ The key takeaway: Focus small, win big.

🚀 The motivational push: Start applying the 80/20 Rule today—and you’ll see your money grow smarter, faster, and stronger.

Related Reads to Boost Your Financial Success

If you found the 80/20 Rule helpful, here are more powerful guides to sharpen your money mindset and build long-term wealth:

7 Daily Habits for Self-Discipline – Discover simple daily routines that strengthen your discipline, helping you stick to financial goals without constant struggle.

Zero-Based Budgeting – Learn how to give every rupee (or dollar) a purpose so you control your money instead of letting it slip away unnoticed.

50/30/20 Rule vs 70/20/10 Rule – Compare two popular budgeting strategies and find out which one works best for your lifestyle and goals.

7 Proven Ways to Protect Money from Inflation – Safeguard your hard-earned savings with smart moves that keep your wealth growing even during rising prices.

👉 Explore these guides to combine Smart Money Habits with the 80/20 Rule, and you’ll have a complete financial success strategy in your hands.