Table of Contents

ToggleIntro – The Arena Is Set: Comparison of Budgeting Rule 50/30/20 vs 70/20/10

In the red corner, we have the 50/30/20 rule — the people’s champion of budgeting, trusted for decades for its simple, balanced approach to money management. In the blue corner, the 70/20/10 rule — a savings-first contender built for those who want to grow wealth with discipline and speed.

Arguments have raged for years over which is the best budgeting method for achieving strong financial results. Today, we step into the arena for the ultimate 50/30/20 vs 70/20/10 showdown.

Why does this comparison matter? Because these two rules have very different priorities: one focuses on a healthy balance between needs, wants, and savings, while the other puts savings and future security in the spotlight. And yet, both claim to be the “best” budgeting method.

Think about it — whenever we search for budgeting or savings tips on Google or YouTube, we find countless videos and blog posts from so-called experts. But how often do we stop and ask ourselves: “Does this method really work for me?” That’s exactly why we’re here — to break down these two popular methods, understand their philosophy, benefits, and drawbacks, and compare them side-by-side.

By the end of this article, you’ll know exactly which rule fits your lifestyle, whether you’re aiming for long-term stability or short-term flexibility. And if you’ve ever been stuck between a balanced budgeting approach and a savings-heavy plan, this guide will finally help you choose the budgeting rule that works for you.

Round 1: Origin Story – Where They Come From: 50/30/20 vs 70/20/10 Budgeting Rules

The 50/30/20 Rule

The 50/30/20 rule was created by U.S. Senator Elizabeth Warren and her daughter, Amelia Warren Tyagi, as a practical guide for working-class families to manage money wisely. Popularized in their 2006 book All Your Worth: The Ultimate Lifetime Money Plan, the method was described as a “good rule of thumb” for organizing spending, preparing for unforeseen expenses, and building long-term financial security.

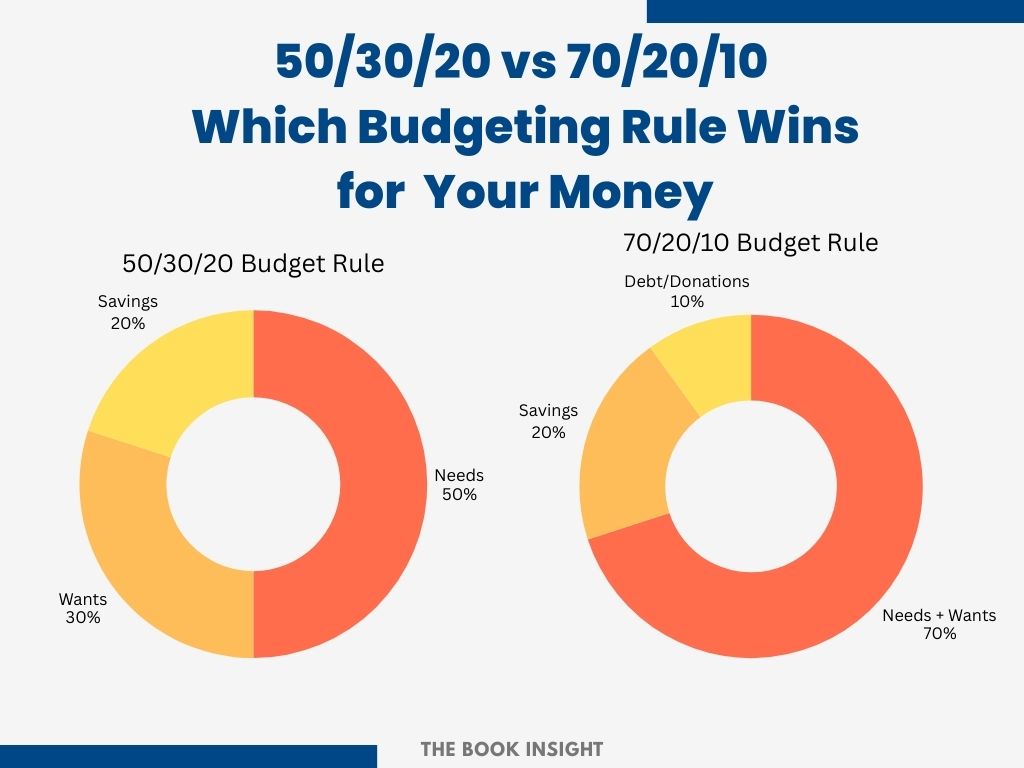

The 50/30/20 budgeting rule divides after-tax income into three categories:

- 50% Needs – essential expenses such as rent, mortgage, utilities, insurance, and groceries.

- 30% Wants – lifestyle choices like entertainment, hobbies, and travel.

- 20% Savings/Debt Repayment – building an emergency fund, investing, or paying off debt.

At its core, the 50/30/20 rule promotes life balance — allowing you to meet obligations, enjoy your present, and still save for the future.

The 70/20/10 Budgeting Rule Explained

The 70/20/10 budgeting rule has no single inventor but has grown in popularity among aggressive savers and those seeking the best budgeting method for savings. It’s often chosen by people who find the 50/30/20 model unrealistic due to high living costs or significant debt obligations.

Under this rule:

- 70% is allocated to needs and wants combined (with a heavier focus on essential costs).

- 20% is dedicated to savings and investments.

- 10% goes toward debt repayment or charitable giving.

Interestingly, the term “70/20/10” also originates from a leadership and learning model developed in the 1980s by Morgan McCall, Michael M. Lombardo, and Robert A. Eichinger at the Center for Creative Leadership — although in finance, it has been adapted into a money management framework.

This method leans toward savings discipline, ensuring a consistent contribution toward wealth-building while maintaining tight control over spending.

Key Difference in Philosophy

While both rules are percentage-based budgeting systems, their philosophies differ:

- 50/30/20 prioritizes balance — ensuring your lifestyle and savings both get attention.

- 70/20/10 prioritizes discipline — channeling more income toward future security and debt reduction.

If the 50/30/20 rule is like a skilled all-rounder in the budgeting arena, the 70/20/10 rule is the lean, savings-focused fighter who wins by sheer financial stamina.

Round 2: The Rules – How the Fighters Move (50/30/20 vs 70/20/10)

Now that we know their origins, it’s time to see how each budgeting fighter moves inside the ring. This is where the 50/30/20 vs 70/20/10 showdown gets real — because understanding the rules is the first step in knowing how to choose a budgeting rule that actually fits your life.

50/30/20 Rule – The Balanced Fighter

The 50/30/20 budgeting method, made famous by Senator Elizabeth Warren, divides your after-tax income into three clear buckets:

🟥 50% Needs – Your essential “must-haves” to keep life running:

- Housing costs (rent, home loan EMI, property taxes)

- Utilities (electricity, water, gas, garbage)

- Transportation (fuel, public transit, car loan EMI, insurance)

- Groceries & basic household items

- Health insurance & medical bills

- Minimum debt repayments (credit card minimum, essential loan EMIs)

- Basic phone & internet plans needed for work/life

🟦 30% Wants – Your lifestyle and personal satisfaction:

- Dining out, coffee shops

- Entertainment (movies, streaming subscriptions)

- Vacations & weekend trips

- Shopping for clothes, gadgets, and home decor (beyond basics)

- Gym memberships, hobbies, sports equipment

- Upgrades to phone, car, or furniture

- Premium plans & luxury services

🟩 20% Savings/Debt Repayment – Your future security:

- Investments (mutual funds, stocks, bonds, ETFs)

- Retirement contributions (EPF, PPF, NPS, 401k equivalents)

- Emergency fund contributions

- Extra mortgage or loan repayments (beyond the minimum)

- Sinking funds for big future purchases (house, car, wedding, education)

70/20/10 Budgeting Rule Explained – The Savings-Heavy Contender

The 70/20/10 rule is often called the best budgeting method for savings by those who want to build wealth quickly. It groups needs and wants together, forcing you to live on a tighter combined budget so that more money goes into savings or debt repayment.

🟥 70% Needs & Wants combined (with more weight on needs)

- Housing, utilities, transportation, groceries

- Health insurance & medical bills

- Phone & internet bills

- Dining out & entertainment

- Shopping (clothes, gadgets, furniture)

- Travel, hobbies & leisure activities

🟦 20% Savings

- Investments (mutual funds, stocks, bonds, ETFs)

- Retirement accounts (EPF, PPF, NPS, IRA, 401k equivalents)

- Emergency fund savings

- Sinking funds for future big goals (house, business, education)

🟩 10% Giving or Extra Debt Repayment

- Additional loan repayments (credit cards, home loan, car loan, personal loans)

- Charitable donations (NGOs, religious giving, community support)

💡 Tip: No debt or donation goals? Redirect this 10% into savings to supercharge wealth-building — making it 30% savings — or invest in personal growth like courses and certifications.

Round 3: Simplicity Punch – Which Is Easier to Follow? (50/30/20 vs 70/20/10)

When deciding how to choose a budgeting rule, one big factor is how easy it is to follow without overthinking every transaction. Even the best budgeting method for savings will fail if it’s too complicated for your lifestyle.

50/30/20 – The Straightforward Contender

The 50/30/20 rule wins big in the simplicity department. It’s beginner-friendly and works like a mental shortcut:

- 50% → All needs covered.

- 30% → Your “fun” and lifestyle spending.

- 20% → Savings and extra debt payments.

Because wants are clearly separated from needs, it’s easier to track your spending and keep lifestyle choices in check. You always know that your personal splurges have a cap — 30% — and the rest goes to life essentials and future goals.

💡 Why it works: People love clarity. With 50/30/20, every dollar has a role, and you can label your responsibilities without mental gymnastics.

70/20/10 – The Savings-Focused Challenger

The 70/20/10 budgeting rule is also simple in theory, but its combined 70% for needs and wants can blur the line between “must-have” and “nice-to-have.” Without discipline, you might end up giving more space to wants and squeezing your needs — or vice versa — which can lead to imbalance.

Then there’s the 10% giving or extra debt repayment category. While it’s a great habit for generosity or faster debt clearance, it can confuse people who have neither debt nor a donation plan. This often leaves them wondering: “Should I just move it to savings? Or spend it? Or invest it?”

(Hint: In Round 4, we’ll show how to make that 10% work harder for you.)

💡 Why it works for some: If your goal is aggressive savings and you’re naturally disciplined with spending, this method can build wealth faster — especially if you redirect the 10% to investments.

Verdict for Simplicity

While both are easy to grasp, 50/30/20 edges out for most beginners because it’s more intuitive and keeps “needs” and “wants” in separate corners. The 70/20/10 rule still shines for advanced savers, but its flexibility can be a double-edged sword if you’re not careful.

Round 4: Savings Power – Who Builds Wealth Faster? (50/30/20 vs 70/20/10)

When it comes to how to choose a budgeting rule, the ultimate question many ask is: “Which one will make me richer, faster?” If you’re searching for the best budgeting method for savings, you have to look beyond percentages and focus on the real driver — the amount you consistently invest, not just the budgeting formula itself.

On paper, both the 50/30/20 rule and the 70/20/10 rule dedicate 20% to savings. But here’s the kicker: the 70/20/10 method has an extra 10% that, if redirected into investments, becomes a serious wealth accelerator.

50/30/20 – Balanced, But Slower Growth

With 20% savings, this rule gives you steady progress toward long-term goals. You can split it between:

- SIPs & Mutual Funds

- ETFs & Stocks

- Bonds or Gold

- Recurring Deposits (RD)

- Retirement accounts (NPS, PPF, 401k equivalents)

The challenge? Lifestyle creep. Since 30% is reserved for wants, undisciplined spenders can let “fun” expenses nibble into their savings potential. This can slow down the compounding effect needed for faster wealth growth.

70/20/10 – The Aggressive Saver’s Edge

The 70/20/10 budgeting rule matches the 20% savings base, but here’s where it flexes:

- The extra 10% is usually for debt repayment or donations.

- Once debt is gone, that 10% can be redirected into wealth-building, turning your budget into a 70/30/0 power plan.

What can you do with that extra 10%?

- Boost Savings to 30% – Speed up investments and reach goals years earlier.

- Skills & Knowledge Fund – Courses, certifications, or tools to increase earning power.

- Emergency Fund Build-Up – Aim for 6–9 months’ worth of living expenses.

- Passion & Creativity Fund – Hobbies, creative projects, or personal enjoyment without touching core savings.

💡 Why it wins: That extra 10% flexibility makes 70/20/10 the best budgeting method for savings if your goal is aggressive wealth growth — especially once debts are out of the way.

Verdict for Savings Power

Winner: 70/20/10 — The ability to push savings up to 30% makes it the stronger choice for aggressive savers. 50/30/20 remains a solid, balanced option for those who want steady progress without a strict savings-first mindset.

Round 5: Real-Life Fit – Who Connects with the Crowd? (50/30/20 vs 70/20/10)

When deciding on how to choose a budgeting rule, it’s not just about percentages — it’s about how the rule fits into your real life. The best budgeting method for savings for one person might be completely wrong for another, depending on income stability, goals, and lifestyle priorities.

Students & Young Professionals – 50/30/20 Has the Edge

For those in their early career or still studying, the 50/30/20 rule offers more breathing room for wants. Parties, weekend trips, upgrading gadgets, or trying new hobbies — these moments can be valuable at a younger stage of life. While it still sets aside 20% for savings, it doesn’t require extreme cutbacks in personal enjoyment.

💡 Key note: Start applying the savings habit early, even if the amount is small — compounding loves time more than size.

Families – 70/20/10 Prioritizes Security

Once family responsibilities enter the picture, savings and financial security become the top priorities. The 70/20/10 budgeting rule works well here because:

- It enforces a strong 20% savings habit.

- The extra 10% for debt repayment or donations can be redirected toward building an emergency fund or growing investments.

- It supports risk protection through insurance without cutting too much into daily needs.

For parents, that extra financial cushion helps prepare for medical emergencies, children’s education, or sudden job changes.

Freelancers & Self-Employed – 50/30/20 Wins for Flexibility

When income fluctuates month-to-month, keeping budgeting simple and adjustable is critical. The 50/30/20 rule divides income into just three buckets, making it easier to scale up or down depending on how good the month was.

It’s also easier to mentally prioritize needs vs. wants without feeling locked into strict percentages that may not match irregular cash flow.

Verdict for Real-Life Fit

Winner: Draw — Lifestyle and priorities matter most.

- If your focus is living in the moment while building basic savings habits → 50/30/20.

- If your focus is security, debt freedom, and aggressive saving → 70/20/10.

Final Round: The Knockout Verdict

When it comes to managing your money, there’s no one-size-fits-all solution — but understanding the pros of each approach makes your choice easier.

- 50/30/20 Rule – Ideal for beginners or those who want a balanced approach to needs, wants, and savings. It offers flexibility and is easier to maintain without feeling restricted.

- 70/20/10 Rule – Perfect for people with a savings-first mindset or those with specific financial goals like paying off debt faster or building wealth aggressively.

If you’re wondering how to choose a budgeting rule, start with the one that feels realistic for your current lifestyle. A smart move is to begin with the 50/30/20 rule to build consistency, and once your income grows or expenses stabilize, shift towards the 70/20/10 rule to supercharge your savings.

And if you want to upgrade your earning potential while improving your financial planning, explore these 7 High Demand Skills for the Next 10 Years to future-proof your income.

In the end, the best budgeting method for savings is the one you can follow without burnout.

Motivational punch: “The best rule is the one you can stick to — because in the ring of personal finance, the real champion is your consistency.”

“Want to master your money game? Subscribe to our free newsletter for proven strategies, practical budgeting tips, and easy-to-follow savings hacks that actually work!”

Related Posts (Finance & Business)

Rich Dad Poor Dad – Summary & Lessons (Finance mindset & wealth building)

The Psychology of Money – Summary & Insights (Smart money decisions)

The Compound Effect – Summary & Lessons (Small actions → big results)

The Science of Happiness – Money & Life Balance Insights (Wealth-life harmony)

Dopamine Detox – How to Stay Focused on Financial Goals (Productivity & discipline)